How to find the best Etsy keywords in 3 simple steps using Alura

If you want to be found in search results on Etsy, you need to optimize your product listing for SEO. And if you want to

join

join

Pricing handmade products is a very important aspect of running a successful and profitable handmade shop — but it can also be very confusing! You want your price to be set at a level where people will buy your product, but you also want to be sure you account for all of your fees! Because these bad boys add up quickly..!

One question I hear a lot is from makers wondering how to account for shipping and other fees in their prices, so in this article we’re going to talk about exactly that.

I will break down the fees, talk about which ones you do and do not need to include in your pricing calculations (and why), and also warn you about the mistake I often see that you do not want to make!

So, ready? Let’s dive in!

When you sell your product, there are many fees you need to pay, and you need to consider those when setting your prices.

Some of them need to be accounted for in your cost of goods sold, others need to be categorized as “overhead,” which is handled differently – and finally, some will just come out of your profit margin.

In any case, your pricing strategy needs to cover them so you can you know… make money.

Before we go into the details, let’s start with a quick review of terms.

First off is PRICE:

Your price is made up of two things: your cost – which I’ll talk about next – plus your markup. So that’s pretty simple.

COST refers to your cost of creation, or cost of production— essentially what it costs to create this product.

So . . . what expenses make up your “cost?”

e-com sales on tap training

simple step-by-step plan to grow your online store sales into a consistent and predictable income with the Reliable eCom Sales System

Now let’s go through the different fee categories and talk about how you account for each one in your pricing calculations.

First off are your marketplace fees. They may be called listing fees, transaction fees, or platform fees.

Basically these are things that you pay for using a platform that’s not yours, where essentially you’re renting a space for your shop.

A mistake I see quite often is when makers try to adjust the price to cover a percentage fee that they are charged by the platform, Paypal, or something else like that.

They add this fee to their price, but the fee is calculated from the price, so once they add the fee—guess what? The fee goes up because the seller increased the price to cover the fee . . . and this loop will go on and on forever.

For example, you have an item that you want to price at $10, that’s how much you want to get after the fee is taken out. If you have to pay a fee of 5% of that $10, the fee will be 50 cents.

And if you want to wrap that into your price to cover the fee, then you need to list the item at $10.50. But if you do, the new fee is not going to be 50 cents, like you just calculated. It’s going to be 5% of $10.50!

And so it’s going to constantly go up, right? You’re going to be stuck in an ever increasing loop— it’s going to be a chicken and an egg problem, and mathematically complicated.

For this reason I advise the makers I work with to estimate these fees and count them as overhead or a selling expense for the year.

In accounting terms the way to deal with those fees is to treat them as a selling or business expense because that’s what they are.

They are not a product cost, so they should not go into your cost of goods sold.

But for the purpose of coming up with your prices you can either estimate what these would be for a year and add that to your overhead rate, or, if you have data from your previous year or previous years in business, then of course use that.

Next are your financial service fees, transactional fees, and merchant fees.

These are essentially a financial service fee that you pay either Etsy, PayPal, stripe— or whichever payment processor you’re using. They help you process payments safely, so you pay a fee for that service. Now, they are a business expense, they are not a product cost and should not be factored into your cost of goods sold, so we want to treat them just like we treated your marketplace fees.

Now it’s time to talk about subscription fees. These consist of things that may be called fees but are actually fixed costs or subscriptions, such as Etsy plus and Pattern fees, WordPress or website hosting fees, Shopify subscriptions, things like that, that you pay each month often as a flat fee.

These are fixed costs that you’re going to have to pay to sell your products online whether you make a sale or not and they all get added to your overhead costs.

You also need to account for your advertising fees. For example, in Etsy these would be your offsite ads and your promoted listing fees.

Even though they’re called fees, they are essentially a marketing expense – they don’t have anything to do with the cost of making your product.

It’s the same as if you were to advertise on Facebook, Google, Pinterest or Instagram — that’s part of your marketing budget.

So how can you account for it in your prices?

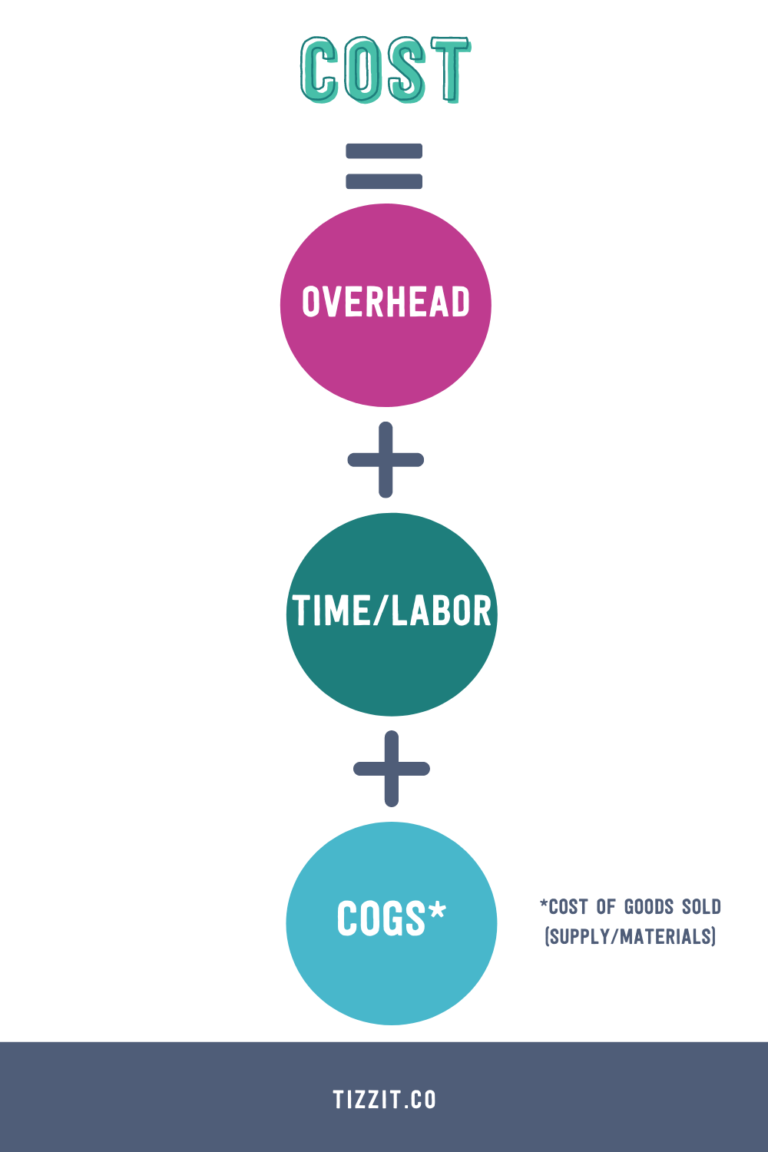

Your cost is made of three elements:

Your overhead is the things you’re going to pay no matter how many sales you make and even if you don’t make any, like your rent, your electricity, your website hosting— things like that.

Time and labor includes paying people to make the products that you make, and/or being able to pay yourself an hourly rate.

And then COGS – or cost of goods sold – now I could do an article juuuuust about COGS but to keep it simple here just know this is essentially your supplies and materials. This only includes things that you use to create the final product, you can’t start adding up all of your marketing, selling and operating expenses in there.

Those marketing, selling, and operating expenses will be paid from your profit, meaning that they’re going to come out of your profit margin and you’re going to take that into consideration when you define your profit margin, or “markup.”

So those are your basic terms when you talk about pricing— if you’re still not feeling clear about which costs are what, go and check out the Tizzit HQ Pricing Course where I dive into this more, or the article on the website about Handmade Business Costs, to make sure you understand these concepts.

I know some sellers will try to average out what their advertising costs would be for a year and add that to their overhead; so for example they’ll say to make $X amount in sales this year I am estimating I’ll spend $Z amount on ads and then use that in their overhead.

It can work, but I find this approach has a few limitations:

It’s really hard to estimate your ads costs as these vary over the year. If you plan to spend a fixed amount on ads every month, say “every month I plan to spend $200” on ads then sure that works.

But in reality, ad costs can go up and down by quite a bit over a year (even over a month!), and they also tend to go up during busy shopping periods where most of your sales might come from… so you might spend more than what you’d estimated.

If you account for those costs in your overhead – you can also quickly over-inflate your prices, because to set your prices, you end up multiplying your costs by your profit markup, and it can go up real fast, pricing you out of the market.

So what can you or should you do?

Look… I’d much prefer you estimate your ad costs and add those to your overhead rather than not account for those advertising costs AT ALL. At the end of the day, for as long as you’re covering them, I am happy!

BUT…

I do think a more proper way to account for them is when setting your profit margin. It needs to be ample enough to allow you to re-invest in your business, and that includes things like advertising.

This way you work with money you already have (your existing profit, cash in the bank) and a clear budget to work with each month, and you can then monitor your paid campaigns closely to make sure that for each product you sold, you are not spending more than the profit margin of that product allows you to spend.

Now let’s talk about some of your shipping costs. The first is the shipping cost for the supplies that you order.

Your supplies are a cost of making your product, and the shipping for these supplies to you also should be included in your cost of goods sold. So if you order 100 dollars worth of supplies and you’re being charged $10 shipping to receive them, your supplies cost is $110, not $100.

The shipping costs you pay to ship the products to your customers are different.

Shipping is not a cost of creating or producing the product, so it doesn’t go into your cost of goods sold.

Putting into your overhead would require you to estimate it, which is nearly impossible because you don’t know which products will sell or where they are going to be shipped, how far, how heavy that specific parcel will be, etc.

Instead, it is much neater to add it to the price on a per-product basis. This is done easily with most e-commerce platforms at checkout and also a transparent way to communicate the shipping cost to the customer.

If you want to offer “free” shipping though … it gets a little more complex. Obviously free shipping is NOT free – so you need to make sure you’re accounting for it in your prices. If you sell on Etsy, I have a VERY in depth article about using free shipping on Etsy that will walk you through any situation you might be in and offer suggestions as to how to handle free shipping for each of those.

You can see how important it is to be aware of all the “fees” you will need to pay so that all of your costs are taken into account in one way or another when you decide your prices.

If you want to dive deeper into pricing, you will want to check out my YouTube playlist that has all of my pricing videos as well as our free Handmade Pricing Calculator —

OR . . . if you want to go one step further and have step by step instructions and pre-made spreadsheets that you can fill in as you go along to determine your pricing, check out the pricing course in Tizzit HQ!

Thanks for reading and until next time, au revoir!

you might also like…

related articles

If you want to be found in search results on Etsy, you need to optimize your product listing for SEO. And if you want to

There has been a lot of talk in the Etsy community — and I mean A LOT of talk — about Etsy’s payment account reserve

Anyone who knows me knows that I am a HUGE advocate for using email marketing to grow and scale your handmade business. But you may

disclaimer

subscribe to youtube

THE LAUNCHPAD

get in touch

We acknowledge and give thanks to the Budawang and Yuin people, the Traditional Owners of the land we work and live on. We pay our respects to all Aboriginal and Torres Strait Islander Peoples and elders past, present and emerging.

learn how to grow your online store sales into a consistent and predictable income